how to pay tax when self employed

Through your online bank account online or telephone banking Faster Payments CHAPS by debit or corporate credit card online at your bank or building society You need a paying-in slip from. Ad TurboTax Helps You File Self-Employed Taxes The Way You Want And With Confidence.

How Self Employment Is Tax Calculated Taxact Blog

Obtaining a Social Security Number If you never had an.

. Ad TurboTax Helps You File Self-Employed Taxes The Way You Want And With Confidence. Our Easy Step-By-Step Process Takes The Guesswork Out Of Filing Self-Employed Taxes. This is your self-employment.

Ad Get Tips on Managing Your Taxes If Youre Recently Self-Employed. Ad We have the experience and knowledge to help you with whatever questions you have. Our clients typically receive refunds 7061 greater than the national average.

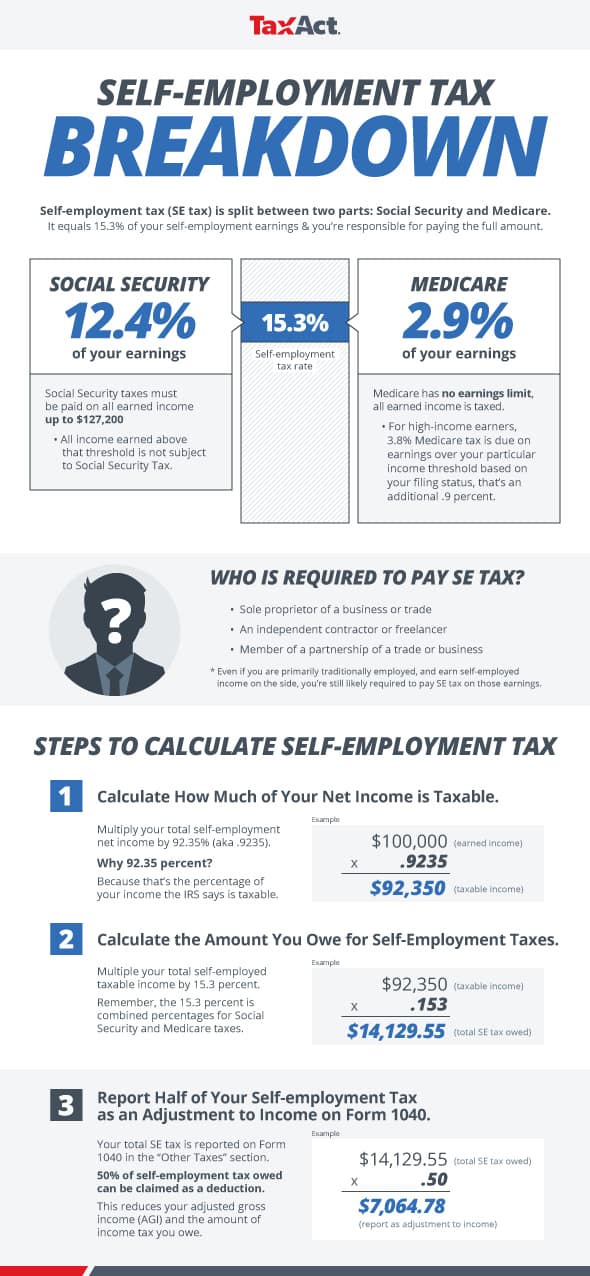

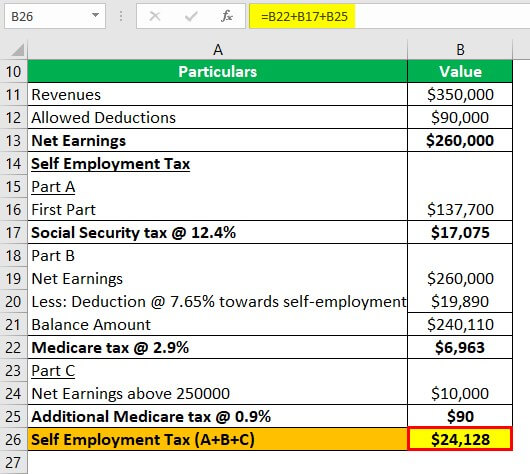

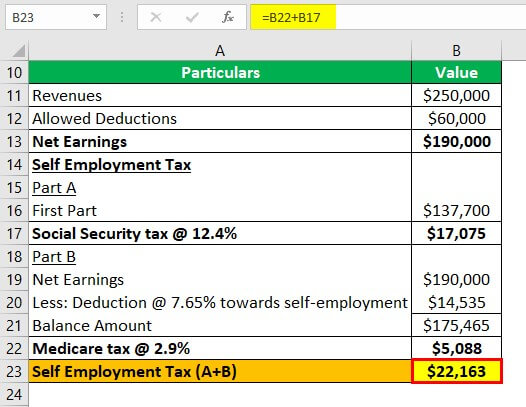

You pay this tax the rate of 126 of that income. Along with withholding and filing your own income tax youll also pay both the employee and employer halves of the FICA tax. Multiply that total times 153.

As a self-employed individual generally you are required to file an annual return and pay estimated tax quarterly. The Medicare Tax is 29 of all of your wages and self-employment income. To do this file a new Form W-4 with your employer.

Self-employed individuals generally must pay self-employment tax. Multiply your profit times 9235 this is giving you a deduction for the employer half of your self employment tax. There is a particular line on Form W-4 for you to enter the additional amount you want your employer to withhold.

To pay self-employment tax you must have a Social Security number SSN or an individual taxpayer identification number ITIN. Well 765 of your income can be deducted to alleviate the total cost of paying both employee and employer-side FICA tax. Read customer reviews find best sellers.

Self-employment tax If you are self-employed you pay self-employment tax SECA based on your net income profit from your business. You pay this tax at a rate of 126. If you work for an employer you and your employer each pay a 62 Social.

Use the IRS Tax. Ad Browse discover thousands of brands. How to pay self-employment tax Generally you use IRS Schedule C to calculate your net earnings from self-employment.

Taxes such as Social Security and Medicare are. Paying Social Security and Medicare taxes. The Additional Medicare Tax is 09 in addition to the.

On Schedule SE in addition to the other tax forms you must file. Of course if the process is too daunting tax consultants such as HBK are the experts in their field when it comes to helping self-employed internationals pay their taxes. If youre self-employed and expect to owe more than 1000 in taxes when you file your tax return the IRS requires you to pay estimated taxes also called quarterly taxes.

If you had self-employment income earnings of 400 or more during the year you are required to pay self-employment taxes and file Schedule SE with your Form 1040. Thats a 124 tax for Social Security and a. This is the percentage of your income thats subject to self.

If you are self-employed you pay self-employment tax SECA based on your net income profit from your business. Discover Helpful Information and Resources on Taxes From AARP. Unlike Social Security there is no income cap.

You use IRS Schedule SE to calculate how much self. Our Easy Step-By-Step Process Takes The Guesswork Out Of Filing Self-Employed Taxes. 10 hours agoThe self-employment tax consists mostly of the Social Security and Medicare taxes paid by self-employed individuals.

Self Employment Tax Everything You Need To Know Smartasset

Self Employment Tax Definition Rate How To Calculate

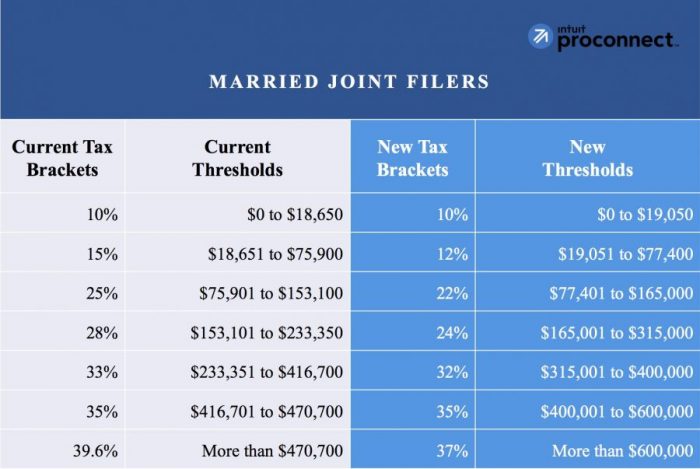

Tax Reform 101 For Self Employed Tax Pro Center Intuit

/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png)

How Much Should You Budget For Taxes As A Freelancer

How To Calculate Your Self Employment Tax Gusto

Self Employment Tax Definition Rate How To Calculate

What Is Self Employment Tax Schedule Se Explained Stride Blog

0 Response to "how to pay tax when self employed"

Post a Comment